SFDR

SFDR website disclosure Vesteda Residential Fund

Summary

Vesteda Residential Fund promotes environmental characteristics, being climate change mitigation and adaptation. Climate change mitigation is attained by reducing the energy consumption its real estate properties. Climate change adaptation is attained by using a physical climate risk assessment to lower high-risk investments to no/ mid climate-risk. Although sustainable investments are not the objective of the Fund, the Fund partially makes sustainable investments. The Fund aims to have 65% sustainable investments. The Fund ensures that those sustainable investments do not significant harm any other environmental or social objectives. The overall long-term goal for the Fund is to have a near-energy-neutral portfolio (also called Paris-proof aligned) before the end of 2050.

All investment proposals contain a sustainability impact score, to ensure continuous alignment with the environmental characteristics. To measure the attainment of the environmental characteristics the Fund measures the energy labels of the real estate, the average kWh per m2 and the share of investments with a no/mid climate-risk. Vesteda obtains the information predominantly directly from the properties and there are certain limitations to the gathering of the data. Engagement is not part of the environmental or social investment strategy as Vesteda does not invest in other companies.

No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have as its objective sustainable investment. The financial product partially invests in sustainable investments. A sustainable investment means an investment in an economic activity that contributes to an environmental or social objective. With our residential real estate Fund, we invest in sustainable investments with a climate mitigation objective, by investing in energy efficient real estate and/or by taking measures to make existing investments more energy efficient.

The real estate is not involved in the extraction, storage, transport or manufacture of fossil fuels and therefore complies with Table 1 of Annex I (sub 17). Further, Vesteda has set thresholds for indicator 18 of Table 1 of Annex I and the relevant adverse sustainability indicators from Table 2 of Annex I of the SFDR Delegated Regulation (EU) 2022/1288. Vesteda has identified which indicators are considered relevant to assess significant harm, and for which sufficient robust data or proxies are available. Vesteda needs to stay below these thresholds to cause no significant harm. The OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights are, for the purpose of this reporting, not applicable because the Fund only invest in directly in real estate and not in companies.

Environmental or social characteristics of the financial product

The product promotes environmental characteristics. Specifically, it promotes climate change mitigation by reducing energy consumption of its real estate in the portfolio. Vesteda takes several measures to reduce the energy consumption of the property portfolio.

Investment strategy

The Fund invests in residential real estate. The overall long-term goal for the Fund is to have a near-energy-neutral portfolio (also called Paris-proof aligned) before the end of 2050. The Fund promotes environmental characteristics. The promoted environmental characteristics are met for the set targets on climate mitigation and climate adaptation. The Fund’s strategy stems from the Investment Guidelines as set out in the Terms and Conditions of the Fund. The strategic principles for the basis for an annual Business Plan, that needs to be approved by the participants of the Fund. The approved Business Plan in its turn forms the basis for the annual strategy, including investments.

The main performance goals set out in the most recent Business Plan are:

• Energy reduction in KWh/m ≈ 55% in 2030 (compared to 1990), a.o. by generating green energy labels and measuring and lowering the actual energy consumption)

• All elevated climate risks mitigated, or measures planned for 2025 at latest

No good governance is assessed because the fund does not invest in investee companies and only in direct real estate properties.

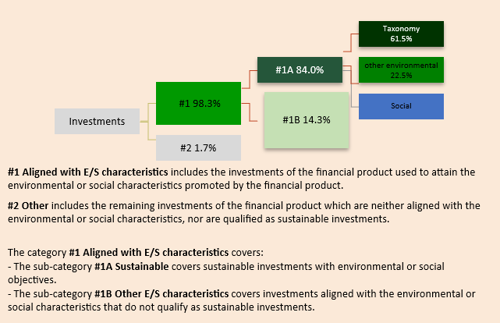

Proportion of investments

In total 98,3% of investments direct investments in real estate properties and are aligned with the environmental characteristics of the product. In total 84% of the investments qualify as sustainable investments under the SFDR of which 61,5% of the investments are taxonomy aligned.

Monitoring of environmental or social characteristics

To achieve the energy reduction target, Vesteda for this purpose, it has developed a CO2 Roadmap, in line with government targets. In order to achieve this target, Vesteda’s sustainability improvement plans are integrated in technical standards which are applied when acquiring, renovating and maintaining real estate assets. Vesteda applies its technical standards to assess whether (potential) investments comply with Vesteda’s sustainability and technical requirements. These standards are, in some cases, even higher than national and local regulations and legislation and also take into consideration the Technical Screening Criteria for climate change mitigation and adaptation in relation to the EU Taxonomy Regulation. In addition, Vesteda uses an ESG risk-framework to determine a sustainability impact score for each new-build or renovation project. This contributes to a broader scope on relevant sustainability risks and factors. As a result, each potential project is assigned a sustainability impact score based on various indicators. The reporting and monitoring phase takes place after project completion. At this stage the property is finished, rented out and operated. Vesteda monitors the performance and impact of sustainability factors. This is conducted by gathering data from the properties and perform property performance tests. The results therefrom and the results from the benchmarks comprise input for our policy on investments decisions and may cause adjustments of Vesteda’s ESG Framework and Technical Standards.

Methodologies for environmental or social characteristics

When applying the methodologies to select the additional indicators, Vesteda strives to use, to the extent possible, science-based targets. They provide a clearly defined pathway for companies to reduce greenhouse gas emissions, helping prevent the worst impacts of climate change and future-proof business growth. Targets are considered ‘science-based’ if they are in line with what the latest climate science deems necessary to meet the goals of the Paris Agreement – limiting global warming to well-below 2°C above pre-industrial levels and pursuing efforts to limit warming to 1.5°C. The focus lies on indicators that Vesteda can influence as owner of the real estate assets; in that regard, Vesteda deems energy consumption intensity the best suitable indicator.

The fund uses the following sustainability indicators to measure whether the promoted environmental characteristics are met:

• Energy consumption intensity: average kWh per m2

• Green labels: % investments with a green energy label (A, B, C)

• Share of investments in market value where no to a mid-climate risk is identified

Data sources and processing

Energy consumption intensity: data provided by energy companies and grid operators.

Energy labels: energy labels in line with the EU Energy Performance of Buildings Directive. The energy label must be determined according to the calculation method NTA 8800. This method applies to existing and new buildings. A certified external party will assess the relevant real estate asset and will register its characteristics in EP-online, the official Dutch database for energy indicators and labels. The database can be consulted to retrieve the energy label for a specific housing unit.

No to a mid-climate risk: Vesteda created an in-house tool, together with Climate Adaptation Services and Sweco, to have insights into the physical climate risks of the portfolio. The tool is unique and combines environmental risks with building-specific characteristics.

Limitations to methodologies and data

Limitations:

- With regard to energy data, the Fund receives anonymized consumption information from energy and network companies. This data does not cover 100% of the Fund’s residential units, only 80-90%. The remainder is estimated based on portfolio averages.

- With regard to climate risks, the accuracy and availability of risk maps for climate risks is not guaranteed, as this is a relatively new subject and insights and data are continuously evolving.

Due diligence

Potential sustainability risks and potential impact on sustainability factors of the proposed investment are identified. Vesteda uses its Technical Standards and an ESG risk framework to assess the ESG performance of the project. The ESG risk framework will be used both to identify sustainability risks and to identify if the investment contributes to Vesteda’s ESG goals. In general, Vesteda assesses new projects and renovation of existing buildings with regard to the quality of the product, sustainability and financial risk and return requirements. A due diligence is performed during the screening and selection phase. The goal is to assess the various sustainability risks and impact on sustainability factors. Vesteda measures a project’s sustainability risks and impact on sustainability factors by benchmarking the project against the sustainability indicators in the ESG framework. After Vesteda has assessed all items in the ESG framework it will result in an overall sustainability impact score for the investment which will be included in the investment proposal. Vesteda will reject a project or renovation in case its SIS falls below a pre-defined threshold, unless there are compelling reasons to not do so. This will have to be motivated and taken up in the relevant investment proposal for consideration of the Management Board and Supervisory Board and/or Participants (depending on the investment amount).

Engagement policies

Vesteda does not invest in investee companies and therefore does not have engagement policies in place.

Designated reference benchmark

There is no designated reference benchmark.

In addition:

Vesteda participates in the Global Real Estate Sustainability Benchmark (GRESB). Vesteda has been awarded five stars in this benchmark and is part of the top 20% worldwide.

Vesteda applies the UN’s Sustainable Development Goals, which defines global sustainable development priorities and aspirations for 2030. This common set of 17 goals and 169 sub-targets call for worldwide action from governments, business and civil society to end poverty, ensure prosperity for all, and protect the planet. We consider the SDGs Affordable and clean energy (7), Sustainable cities (11) and Responsible consumption and production (12) the most relevant to our activities, based on what we do and our ambitions.

Vesteda uses the GRI Standards to report on its ESG policy in its annual report.

Vesteda is committed to the Paris Proof Commitment of the Dutch Green Building Council

These standards predominantly aim at setting disclosure standards in order to prevent greenwashing. In addition, they serve as benchmark tools to compare peer groups. As such, these standards usually do not provide concrete indicators to align with the Paris Agreement; they rather provide ambitions, reporting standards and tools to come to such alignment.

SFDR disclosure

As part of our SFDR disclosure obligations, we make available to you:

Policy on the integration of sustainability risks and factors into the investment decision making process

This policy describes how sustainability risks and factors are taken into account in Vesteda’s investment decision-making process.

Principal adverse impact statement

This document describes the principal adverse impacts of Vesteda’s investment decisions on sustainability factors.

Remuneration policy and integration of sustainability risks

This policy describes how sustainability risks and factors are taken into account in Vesteda’s remuneration policy for management board and management team.

Pre-contractual disclosure of a product that promotes E/S characteristics (“article 8” document)

This document sets out mandatory information in relation to the product.

Investment Memorandum (for investors only)

The investment memorandum includes information on the manner in which sustainability risks are integrated into Vesteda’s investment decisions and the results of the assessment of the likely impacts of sustainability risks on the returns of Vesteda Residential Fund.

Transparency of the promotion of environmental or social characteristics and of sustainable investments (“article 10” disclosure)

This document provides further disclosures in a structured and concise manner.

Documents

Disclosures